The 3-Minute Rule for Clark Wealth Partners

The Buzz on Clark Wealth Partners

Table of ContentsThe smart Trick of Clark Wealth Partners That Nobody is DiscussingGetting The Clark Wealth Partners To WorkClark Wealth Partners - The FactsClark Wealth Partners Fundamentals ExplainedWhat Does Clark Wealth Partners Do?Some Known Details About Clark Wealth Partners The 5-Second Trick For Clark Wealth Partners5 Easy Facts About Clark Wealth Partners Shown

Whether your goal is to maximize lifetime providing, guarantee the care of a dependent, or assistance charitable reasons, critical tax and estate planning assists shield your tradition. Investing without an approach is among the most typical challenges when building wide range. Without a clear strategy, you may catch panic selling, frequent trading, or profile misalignment.I've attempted to mention some that imply something You actually want a generalist (CFP) that may have an extra credential. The CFP would certainly after that refer you to or work with lawyers, accountants, and so on.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

Likewise this is probably on the phone, not face to face, if that issues to you. commissions. (or a mix, "fee-based"). These organizers remain in part salespeople, for either financial investments or insurance coverage or both. I would certainly stay away however some people are comfy with it - https://royal-ink-5a2.notion.site/Why-Working-With-the-Best-financial-advisors-illinois-Can-Transform-Your-Future-2b661d151d8b80fdae79fda62be2de2c. percentage-of-assets fee-only. These planners obtain a fee from you, however as a portion of financial investment assets handled.

There's a franchise business Garrett Planning Network that has this kind of organizer. There's an organization called NAPFA () for fiduciary non-commission-based coordinators.

Clark Wealth Partners for Beginners

There are about 6 textbooks to dig through. You won't be an experienced professional at the end, however you'll recognize a great deal. To get a real CFP cert, you need 3 years experience on top of the programs and the examination - I have not done that, just the book learning.

bonds. Those are the most vital investment choices.

Little Known Questions About Clark Wealth Partners.

No two individuals will certainly have quite the very same collection of financial investment methods or options. Relying on your objectives in addition to your resistance for threat and the moment you need to seek those objectives, your advisor can assist you identify a mix of investments that are proper for you and made to help you reach them.

Ally try this out Financial institution, the company's straight financial subsidiary, provides a range of deposit items and services. Credit score items are subject to authorization and added terms and problems apply.

, is a subsidiary of Ally Financial Inc. The information had in this write-up is given for basic educational purposes and ought to not be interpreted as investment suggestions, tax obligation recommendations, a solicitation or deal, or a referral to acquire or offer any type of safety.

More About Clark Wealth Partners

Securities items are andOptions involve risk and are not ideal for all investors (st louis wealth management firms). Evaluation the Characteristics and Risks of Standard Alternatives sales brochure before you start trading options. Alternatives capitalists may shed the entire amount of their investment or more in a fairly brief time period. Trading on margin involves threat.

Clark Wealth Partners for Dummies

Application Store is a service mark of Apple Inc. Ally and Do It Right are registered service marks of Ally Financial Inc.

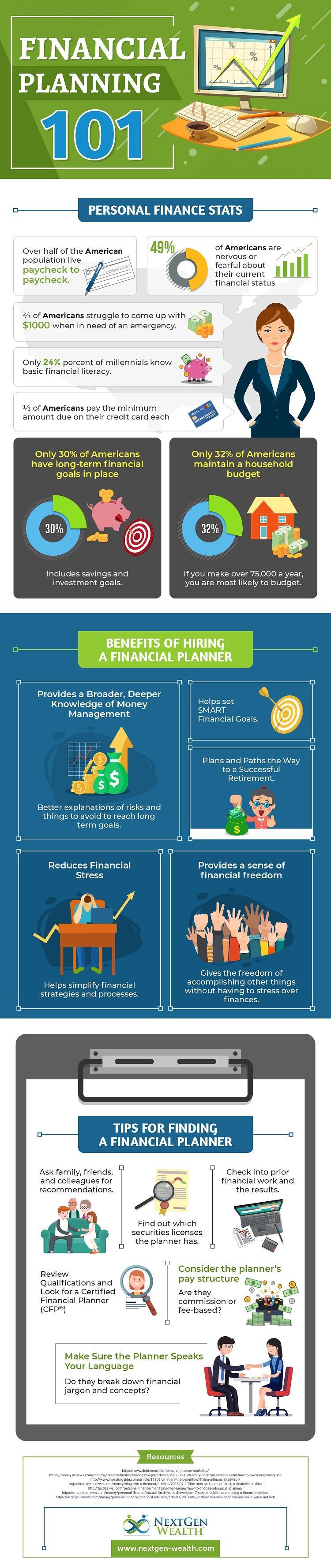

Managing your financial future can feel overwhelming. With a lot of relocating partsinvestments, retired life, tax obligation strategies, risk administration, and estate planningit's easy to really feel shed. That's where economic consultants and monetary coordinators come inguiding you through every decision. They can function with each other to assist you strategy and stay on track to reach your objectives, yet their duties stand out.

Indicators on Clark Wealth Partners You Need To Know

An economic advisor helps keep you grounded in the daily, while a monetary organizer ensures your choices are based on lasting goals. Financial consultants and economic planners each bring various ability sets to the table.

Do you plan to retire eventually? Perhaps obtain wed or go to college? How around paying down some financial debt? These are all reasonable and attainable economic goals. For much of us, nevertheless, it's not always clear just how to make these desires come to life. Which's why it could be an excellent idea to get some professional assistance.

The 6-Second Trick For Clark Wealth Partners

While some advisors supply a vast array of solutions, several specialize just in making and taking care of financial investments. A good advisor should have the ability to supply support on every element of your monetary situation, though they might concentrate on a particular area, like retirement preparation or wide range management. Make certain it's clear from the get-go what the cost includes and whether they'll spend even more time focusing on any area.